IPTV monthly cost australia is changing how Aussies watch TV. As traditional cable and satellite services decline, internet protocol television has emerged as the dominant force in Australian home entertainment, offering unprecedented flexibility and value. According to the Australian Communications and Media Authority (ACMA), streaming services now reach 19 million Australians, with subscription video-on-demand revenue exceeding $3.8 billion in 2024.

IBISWorld reports that the average Australian household now spends approximately $52 monthly on streaming services, yet many remain unaware of how IPTV can deliver superior content diversity at competitive prices. Understanding IPTV monthly costs is essential for making informed decisions about legal, affordable streaming that works seamlessly with Australia’s NBN infrastructure.

At IPTVAUSSIE.com, we’ve tested dozens of providers across various NBN tiers to deliver accurate, experience-based guidance. This comprehensive guide breaks down everything Australian consumers need to know about IPTV subscription prices, hidden costs, and how to maximize value while staying within legal boundaries.

Understanding IPTV in the Australian Context

What is IPTV and Why It’s Popular in Australia?

Internet Protocol Television (IPTV) delivers television content through internet connections rather than traditional terrestrial, satellite, or cable formats. Unlike on-demand streaming services like Netflix or Stan that offer curated libraries, IPTV typically provides live television channels, catch-up TV, and video-on-demand content in a package that mirrors traditional pay TV experiences.

Australia’s widespread NBN rollout has created ideal conditions for IPTV adoption. With approximately 12.5 million premises now connected to the National Broadband Network, Australians have access to internet speeds capable of supporting high-quality IPTV streaming. The NBN’s Standard Plus (NBN 50) and Fast (NBN 100) tiers provide sufficient bandwidth for multiple simultaneous HD streams, making IPTV a practical solution for households wanting to replace or supplement traditional television services.

The popularity surge also reflects changing consumer preferences. Australians increasingly reject the rigid channel packages and lengthy contracts associated with traditional pay TV. IPTV services typically offer month-to-month flexibility, customizable channel selections, and the ability to watch content across multiple devices—from smart TVs and streaming boxes to smartphones and tablets. This flexibility particularly appeals to younger demographics and households seeking budget-friendly alternatives to services like Foxtel, which can cost upward of $100 monthly for comprehensive sports and entertainment packages.

Legal vs Unregulated IPTV Services: Why It Matters for Australians

The Australian IPTV landscape includes both legitimate services operating with proper content licensing and unregulated providers offering unauthorized streams. This distinction profoundly impacts pricing, reliability, and legal risk.

Legal IPTV providers in Australia obtain broadcasting rights through legitimate channels, paying content creators and distributors for the material they deliver. Services like Fetch TV, Kayo Sports, Optus Sport, and international options such as Sling TV (accessible via VPN) operate within copyright law frameworks. These providers typically charge higher monthly fees—ranging from $12 to $50 AUD—but offer guaranteed service quality, customer support, and legal protection for subscribers.

Unregulated IPTV services, often marketed through social media or obscure websites, typically offer “too good to be true” pricing—frequently under $15 monthly for thousands of channels. These services operate in legal grey zones or outright illegality, streaming content without proper authorization. While initially cheaper, they carry significant risks:

Legal consequences: Australian copyright law allows rights holders to pursue both providers and users of unauthorized streaming services. The Copyright Act 1968 includes provisions for civil penalties, and while prosecution of individual subscribers remains rare, it’s not impossible.

Financial risks: Unregulated providers frequently disappear without notice, taking prepaid subscription fees with them. They may also harvest payment information and personal data for fraudulent purposes.

Service unreliability: Without legal infrastructure, these services experience frequent outages, channel removals, and quality fluctuations that undermine their value proposition.

Security vulnerabilities: Many unregulated IPTV apps contain malware or demand excessive device permissions that compromise user privacy.

For Australian consumers, the modest premium paid for legal iptv australia services provides peace of mind, consistent quality, and support that justifies the difference in monthly cost.

Hidden Costs: Setup Fees, Hardware, and VPN Subscriptions

When calculating true IPTV monthly cost australia figures, subscription fees represent only part of the equation. Several additional expenses can significantly impact total expenditure:

Hardware requirements: While many IPTV services work on existing smart TVs, optimal performance often requires dedicated streaming devices. Popular options include:

- Amazon Fire TV Stick 4K: $79–99 AUD one-time cost

- Apple TV 4K: $219–319 AUD one-time cost

- Android TV boxes: $60–200 AUD one-time cost

- Dedicated IPTV set-top boxes (like Fetch Mighty): $449 AUD or monthly rental fees

Setup and activation fees: Some IPTV providers charge initial setup fees ranging from $10–50 AUD. Fetch TV, for example, includes hardware costs but may bundle installation services. These one-time charges should be factored into first-year cost calculations.

VPN subscriptions: Australians accessing international IPTV content or seeking enhanced privacy often use Virtual Private Networks. Quality VPN services cost $5–15 AUD monthly. While not strictly necessary for domestic legal services, VPNs provide geo-unblocking capabilities and additional security layers. Popular options like NordVPN, ExpressVPN, and Surfshark offer Australian servers and competitive pricing, typically around $8–12 monthly when purchased annually.

Internet speed upgrades: IPTV streaming demands consistent bandwidth. A single HD stream requires approximately 5–8 Mbps, while 4K content needs 25+ Mbps. Households with multiple simultaneous streams may need to upgrade from NBN 25 ($60–75 monthly) to NBN 50 ($70–85 monthly) or higher tiers, adding $10–30 to monthly costs.

Ethernet cables and network equipment: Wireless streaming works adequately on strong Wi-Fi networks, but wired connections provide superior stability for IPTV. Quality ethernet cables ($10–30) and potential mesh Wi-Fi systems ($200–600 one-time) represent optional but beneficial investments.

When assessing IPTV plans australia pricing, calculating these supplementary costs provides a realistic picture of total monthly expenditure.

Typical IPTV Monthly Costs in Australia: 2024-2026 Breakdown

Budget Tier: Under $15 AUD/Month

The entry-level IPTV segment in Australia’s legal market offers limited but functional options for cost-conscious consumers. Services in this price range typically provide:

Kayo Sports Basic ($12/month as of 2025): Australia’s premier sports streaming platform offers comprehensive live and on-demand sports content, including AFL, NRL, cricket, rugby union, soccer, motorsports, and international competitions. The basic plan supports two simultaneous streams in HD quality with a 7-day free trial. While focused exclusively on sports rather than general entertainment, Kayo delivers exceptional value for sports enthusiasts, effectively replacing much more expensive Foxtel sports packages.

Channel limitations: Budget IPTV services at this price point rarely offer extensive channel lineups. Most focus on specific content niches—sports, news, or regional programming—rather than comprehensive entertainment packages.

Quality considerations: HD streaming is standard, but 4K content remains rare in this tier. Electronic Program Guides (EPGs) may be basic, and catch-up functionality is often limited to 7 days rather than the 14–30 days offered by premium services.

Device restrictions: Simultaneous stream limits (typically 1–2 devices) restrict household viewing flexibility. Larger families or those wanting to watch different content simultaneously will find these plans restrictive.

Content gaps: Budget tiers typically exclude premium movie channels, extensive international content, and comprehensive VOD libraries. They serve well as supplements to free-to-air television or other streaming subscriptions rather than complete standalone solutions.

For single viewers or specific use cases (like sports-only viewing), budget-tier legal iptv pricing australia options deliver solid value. However, families and those seeking comprehensive channel selection will likely need mid-tier options.

Mid-Tier: $15–30 AUD/Month

This price range represents the sweet spot for most Australian households, balancing affordability with features and content variety:

Optus Sport ($24.99/month): Provides exclusive English Premier League coverage plus UEFA Champions League, Europa League, and J-League content. The service supports multiple devices, offers HD streaming, and includes comprehensive match replays and highlights. For soccer fans, this subscription is essential, as Optus holds exclusive Australian rights to Premier League matches.

Fetch TV (approximately $20–30/month depending on package): Australia’s established IPTV platform offers various channel packages combining free-to-air channels, subscription add-ons, and streaming app integration. Fetch provides excellent EPG functionality, robust catch-up TV (Fetch Replay), and integration with services like Netflix, ABC iview, and YouTube. The platform requires Fetch hardware (Mighty or Mini set-top boxes) but delivers a polished, comprehensive IPTV experience comparable to traditional pay TV at lower cost.

International IPTV services (via VPN): Services like Sling TV ($25–30 USD monthly, approximately $38–45 AUD) offer American channel lineups accessible through VPN connections. These services provide sports, news, and entertainment content not readily available through Australian providers. While technically accessible, VPN requirements and currency conversion add complexity and cost.

Features at this tier:

- HD quality as standard: Most mid-tier services deliver 1080p streaming with adaptive bitrate technology that adjusts quality based on connection speeds.

- Comprehensive EPGs: Detailed program guides with 7–14 day forward schedules, series recordings, and reminder functionality.

- Catch-up TV: Extended replay windows (7–14 days) for most channels, allowing flexible viewing schedules.

- Multi-device support: Typically 2–3 simultaneous streams, accommodating household viewing patterns.

- App ecosystems: Integration with popular streaming services, eliminating the need for multiple input switches.

- Customer support: Responsive help desks, online troubleshooting resources, and Australian-based support teams.

Mid-tier iptv subscription price australia options suit most households seeking to replace traditional pay TV with flexible, affordable alternatives. The combination of live channels, catch-up functionality, and streaming app integration creates comprehensive entertainment ecosystems at reasonable monthly costs.

Premium Tier: $30+ AUD/Month

Premium IPTV services in Australia cater to demanding viewers seeking maximum content variety, cutting-edge features, and uncompromising quality:

Kayo Sports Premium ($25/month): While technically priced at the mid-tier upper end, Kayo’s premium plan deserves mention for supporting three simultaneous streams, making it suitable for sports-enthusiastic households where multiple family members watch different events concurrently.

Fetch TV Premium Packages ($40–60+/month): Fetch’s premium bundles combine extensive channel lineups with add-on subscriptions like Lifestyle Pack, Entertainment Pack, and Kids Pack. These comprehensive packages rival Foxtel’s offerings while maintaining lower monthly costs and avoiding lengthy contracts.

International Premium Services: Platforms like fuboTV (accessible via VPN) offer $60–80 USD monthly (approximately $90–120 AUD) packages with hundreds of channels, including regional sports networks, international entertainment, and premium movie channels. While expensive, these services provide content unavailable through any Australian provider.

Premium tier features:

- 4K streaming capability: Select content in Ultra HD resolution, particularly for major sporting events and blockbuster movies.

- Extensive channel counts: 100+ channels spanning sports, news, entertainment, documentaries, lifestyle, and international content.

- Comprehensive VOD libraries: Thousands of on-demand movies and TV series supplementing live programming.

- Unlimited or high simultaneous streams: 3–5+ concurrent streams supporting large households.

- Advanced DVR functionality: Cloud-based recording with hundreds of hours of storage, series recording automation, and extended retention periods.

- Premium support: Priority customer service with faster response times and dedicated support channels.

- Multiple profiles: Individual user profiles with personalized recommendations and watch history.

Premium iptv plans australia appeal to households replacing comprehensive pay TV packages, international content enthusiasts, and those unwilling to compromise on quality or features.

IPTV Monthly Cost vs Traditional Streaming Services

Comparing IPTV monthly cost australia figures against traditional streaming and pay TV options illuminates relative value:

Traditional Pay TV (Foxtel):

- Basic packages: $49–69/month

- Sports packages: Additional $29–49/month

- Movie channels: Additional $20–30/month

- Premium bundles: $100–130/month

- Contracts: Typically 12–24 months

- Installation fees: $0–150

- Hardware: Set-top box rental or purchase

IPTV Services (Legal):

- Budget: $12–15/month (specialized content)

- Mid-tier: $15–30/month (comprehensive packages)

- Premium: $30–60/month (extensive content)

- Contracts: Month-to-month flexibility

- Installation: Self-service or minimal fees

- Hardware: Use existing devices or one-time purchase

Streaming Services (On-Demand):

- Netflix: $6.99–22.99/month (depending on tier)

- Stan: $12–21/month

- Disney+: $13.99–17.99/month

- Amazon Prime Video: $6.99/month or $79/year

IPTV’s value proposition becomes clear when comparing content variety and cost. A mid-tier IPTV service ($20–30/month) provides live channels, catch-up TV, and often integrated streaming apps—functionality requiring multiple separate subscriptions from traditional providers at higher combined costs. For sports content specifically, Kayo at $12–25/month delivers what would cost $78–118/month through Foxtel’s sports packages.

Australian households using best iptv deals australia can effectively replace $100–150 monthly pay TV bills with $25–45 IPTV subscriptions, redirecting savings toward higher-tier NBN plans for better streaming performance or additional specialized streaming services.

Factors Influencing Your IPTV Monthly Bill

Number of Devices and Simultaneous Connections

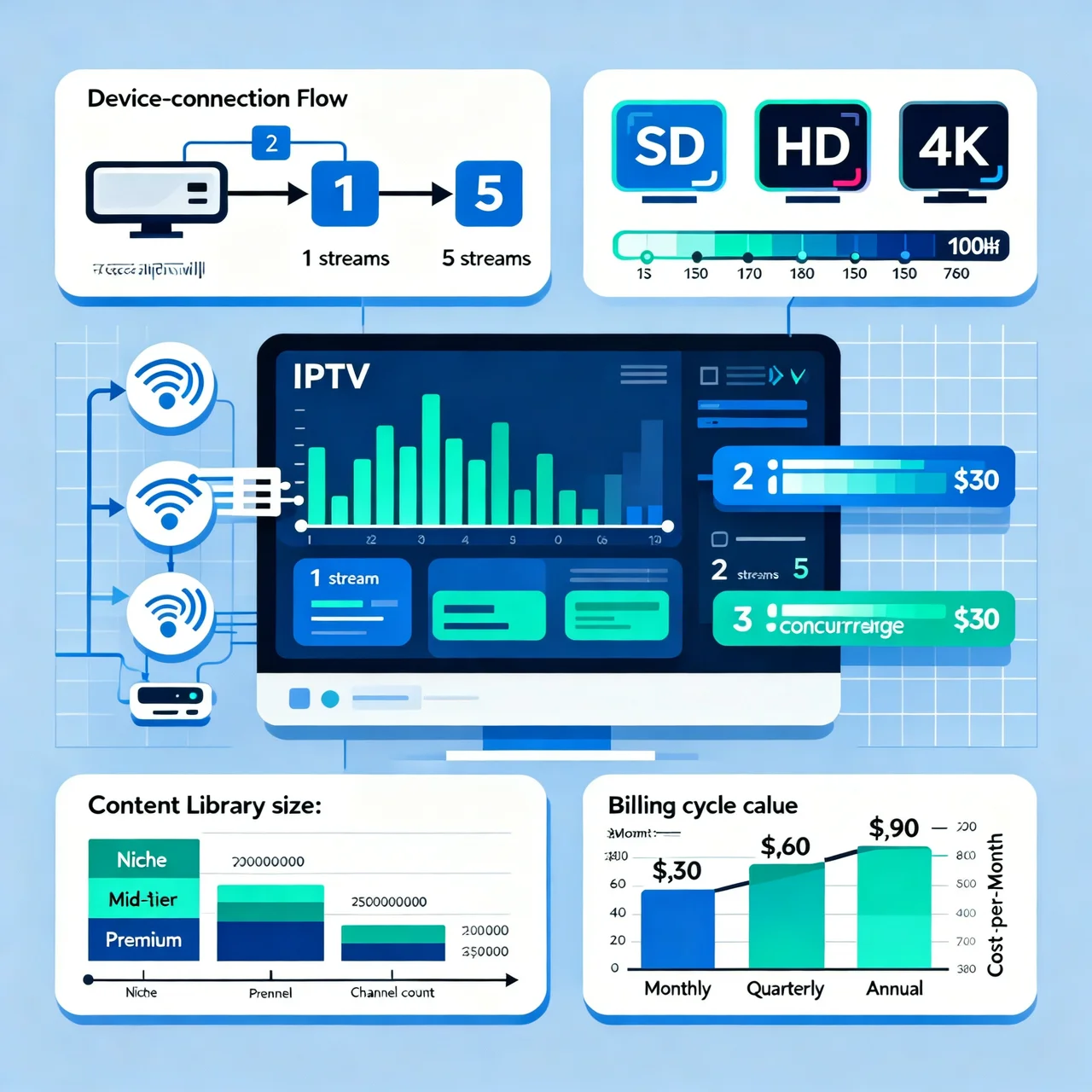

Simultaneous stream limits represent a primary cost differentiator among IPTV plans. Providers tier pricing based on concurrent connections:

Single-stream plans ($12–18/month): Adequate for individuals or couples with aligned viewing schedules. These plans prevent watching on multiple devices simultaneously—attempting to start a second stream terminates the first.

Dual-stream plans ($20–28/month): The most popular configuration, supporting two simultaneous streams. This arrangement suits couples, small families, or households where viewing typically occurs in common areas.

Multi-stream plans ($28–40/month): Premium options supporting 3–5 concurrent streams accommodate larger families, households with diverse viewing preferences, or those wanting flexibility to watch in multiple rooms simultaneously.

Stream limits impact practical usability significantly. A household with teenagers will quickly exhaust a dual-stream plan during peak evening hours. Conversely, single-person households rarely benefit from multi-stream capabilities, making single-stream plans optimal for minimizing monthly costs.

When evaluating cheap legal iptv australia options, assess actual household viewing patterns. Adding streams costs $5–10 monthly per additional connection—reasonable if needed, wasteful if not.

Video Quality Selections

Resolution tiers dramatically impact bandwidth consumption and, increasingly, subscription costs:

Standard Definition (SD): 480p resolution consuming approximately 3–4 Mbps bandwidth. Rarely offered by modern legal IPTV providers except as fallback options during network congestion. Picture quality appears noticeably inferior on screens larger than 32 inches.

High Definition (HD): 720p–1080p resolution consuming 5–8 Mbps bandwidth. The current industry standard, HD provides excellent picture quality on screens up to 65 inches. All legal iptv pricing australia options include HD streaming as baseline capability.

Ultra High Definition (4K): 2160p resolution consuming 25+ Mbps bandwidth. Available selectively on premium plans for specific content (major sporting events, blockbuster movies, nature documentaries). Requires 4K-capable display devices and NBN 50+ internet plans for reliable streaming. Few Australian IPTV providers offer extensive 4K libraries due to bandwidth costs and content availability.

Most Australian IPTV services include HD streaming in base pricing without tiered quality options. This contrasts with Netflix’s model (Basic SD at $6.99, Standard HD at $16.99, Premium 4K at $22.99 monthly). The IPTV approach simplifies selection but means quality-conscious viewers don’t pay premiums for HD access, while those accepting SD quality can’t reduce costs.

4K streaming remains a premium feature primarily available through specialized sports services (select Kayo events) and premium international providers. Australian NBN infrastructure limitations—particularly in regional areas—mean 4K IPTV adoption lags behind capability, reducing immediate cost impacts.

Content Variety and VOD Libraries

Channel counts and on-demand content breadth significantly influence iptv subscription price australia positioning:

Niche services (sports-only, news-only): Lower prices ($12–20/month) reflect focused content. Kayo’s comprehensive sports coverage at $12–25/month represents exceptional value for sports fans but provides zero entertainment, movie, or general television content.

Balanced packages (50–100 channels): Mid-tier pricing ($20–35/month) delivers news, sports, entertainment, lifestyle, and children’s programming. Services like Fetch TV’s mid-range packages provide sufficient variety for mainstream household viewing.

Comprehensive packages (100+ channels): Premium pricing ($35–60+/month) includes international channels, premium movie services, specialized interest content (cooking, travel, history), and extensive ethnic programming. These packages appeal to multicultural households and content enthusiasts unwilling to compromise on selection.

VOD library significance: Extensive on-demand movie and series libraries add substantial value but increase provider licensing costs, elevating subscription prices. Services bundling thousands of VOD titles alongside live channels charge premiums over live-only offerings.

Australian consumers should prioritize content alignment over channel counts. A 200-channel package provides little value if only 20 channels receive regular viewing. Focused services delivering desired content at lower prices outperform bloated packages with unused channels at higher costs.

Subscription Term Discounts

Payment frequency dramatically impacts effective monthly rates:

Monthly billing: Maximum flexibility with month-to-month cancellation freedom. Standard advertised pricing typically reflects monthly billing rates. Ideal for trial periods or uncertain commitment levels.

Quarterly billing: 10–15% discounts common ($20 monthly service = $54–57 quarterly, $18–19 effective monthly rate). Balances commitment with meaningful savings. Reasonable option once service satisfaction is confirmed.

Annual billing: 20–30% discounts standard ($20 monthly service = $168–192 annually, $14–16 effective monthly rate). Maximizes savings but requires upfront payment and year-long commitment. Best for established services with proven reliability.

For example, Kayo Sports Basic at standard $12 monthly billing totals $144 annually. Annual prepayment (when offered during promotional periods) can reduce this to approximately $110–120, saving $24–34 yearly—effectively two months free.

Annual commitments carry risks. Service quality deterioration, changing viewing preferences, or provider business failures (rare among established legal services but possible) can trap subscribers in unsatisfactory arrangements. For nbn iptv costs australia planning, we recommend monthly billing during initial 1–3 month trial periods, transitioning to annual billing once satisfaction is established.

Niche Premium Content

Specialized content adds incremental costs:

Premium sports packages: Access to specific sporting codes, international leagues, or exclusive events. For example, comprehensive UFC coverage, international cricket tours, or niche motorsports may require add-on packages costing $5–15 monthly above base sports subscriptions.

Regional language content: Ethnic programming in languages beyond English requires specialized providers or add-on packages. Indian, Chinese, Italian, Greek, and Middle Eastern content packages typically cost $15–30 monthly, targeting specific diaspora communities.

Adult content: Age-restricted programming available through separate providers or restricted channels costs $10–25 monthly. Legal Australian providers operating in this space maintain strict age verification and comply with classification requirements.

Ultra-premium movie channels: Access to first-run movies and exclusive content from premium studios costs $10–20 monthly as add-ons to base packages.

Niche content appeals to specific audiences willing to pay premiums for specialized programming unavailable through mainstream services. When calculating total iptv monthly cost australia expenditure, these add-ons can push bills substantially higher than base subscription prices suggest.

Cost Analysis & Value Proposition

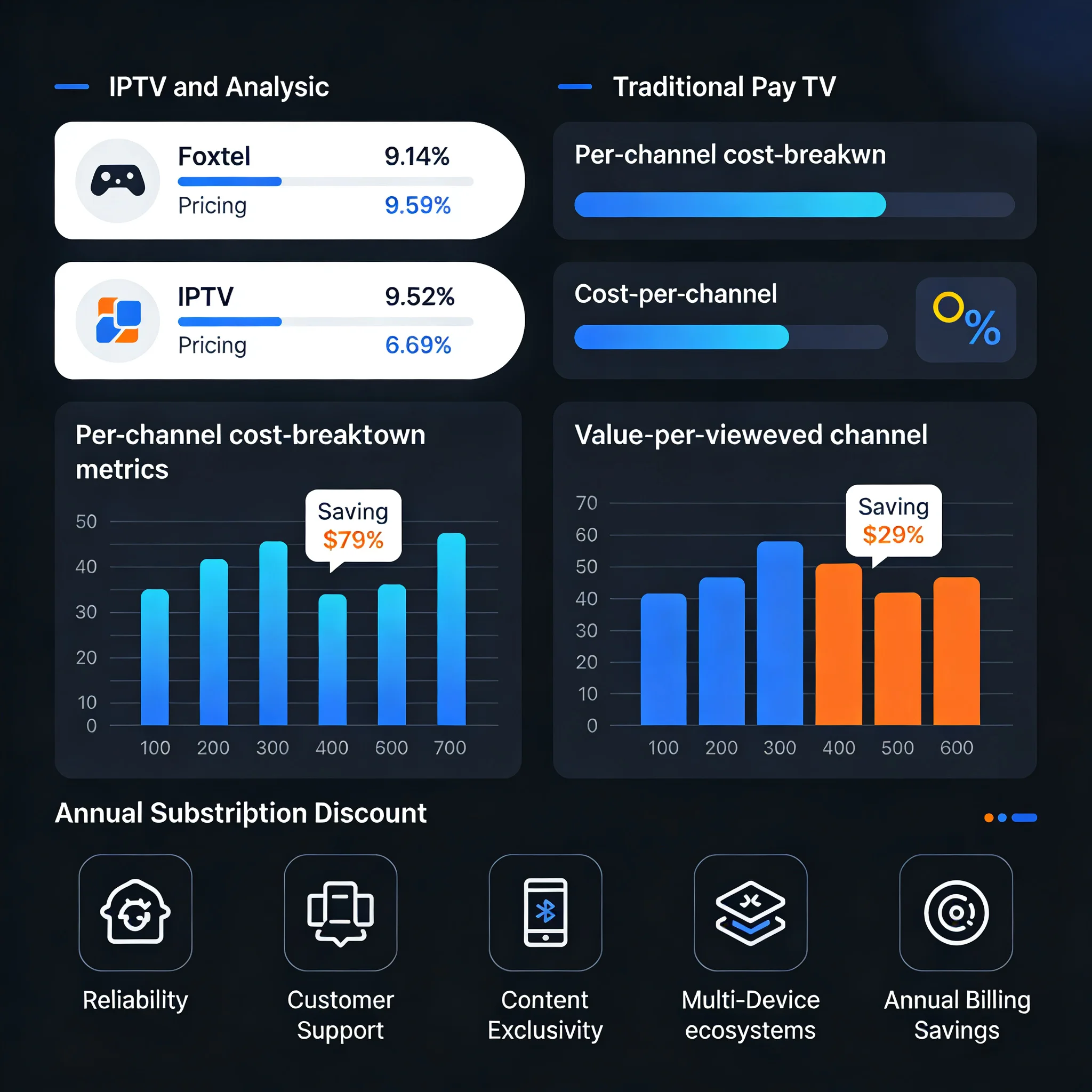

Cost Per Channel vs Traditional Pay TV

Analyzing cost efficiency through per-channel pricing illuminates IPTV’s value:

Foxtel Premium Package: Approximately $120 monthly for 150+ channels = $0.80 per channel monthly. However, most subscribers watch fewer than 20 channels regularly, yielding an effective cost of $6 per viewed channel monthly.

Mid-tier IPTV (Fetch TV): Approximately $30 monthly for 50–70 channels = $0.43–0.60 per channel monthly. With focused channel curation, subscribers typically watch 15–20 channels, yielding $1.50–2 per viewed channel monthly.

Niche IPTV (Kayo Sports): $12 monthly for comprehensive sports content across 50+ live channels and events = $0.24 per channel monthly. Sports fans typically engage with 10–15 channels/events monthly, yielding $0.80–1.20 per viewed channel monthly.

These calculations reveal IPTV’s structural advantage: focused channel selections aligned with subscriber interests deliver superior value compared to bloated traditional packages with 70–80% unwatched content.

Beyond per-channel calculations, IPTV’s month-to-month flexibility eliminates waste from unused services. Traditional pay TV contracts lock subscribers into 12–24 month commitments regardless of usage patterns. IPTV subscribers can pause subscriptions during periods of reduced viewing (extended holidays, busy work seasons) and resume without penalties—an option unavailable with contracted services.

When Paying More is Justified

Not all IPTV services are equal. Understanding when premium pricing delivers commensurate value helps optimize spending:

Superior reliability: Established legal providers invest in robust infrastructure—redundant servers, content delivery networks (CDNs), and quality assurance—minimizing buffering, outages, and stream quality issues. Paying $25–35 monthly for consistently reliable service outweighs saving $10 monthly on unreliable alternatives that frustrate viewers during crucial moments (sports finals, season finales).

Comprehensive EPG and catch-up: Premium services offer detailed program guides, extended catch-up windows (14–30 days), and smart recording features. These conveniences justify $5–10 monthly premiums over basic services with minimal guides and limited replay functionality.

Multi-device ecosystem: Services supporting seamless switching between TVs, tablets, smartphones, and computers provide value for households with diverse viewing patterns. Premium plans enabling synchronized viewing across devices warrant higher costs for families prioritizing flexibility.

Customer support quality: Australian-based support teams with technical expertise, reasonable response times, and multichannel contact options (phone, email, live chat) add value during troubleshooting. Budget services often provide minimal or offshore support, creating frustration when issues arise.

Content exclusivity: Some premium content—EPL soccer, specific international leagues, first-run movies—is only available through specific providers at specific price points. For passionate fans, premium pricing for exclusive access represents acceptable cost.

For best iptv deals australia hunting, prioritize reliability, features, and content alignment over absolute lowest pricing. The frustration and time waste from unreliable cheap services quickly negates modest savings.

Annual Subscriptions: Maximizing Long-Term Savings

Strategic subscription management significantly reduces long-term IPTV costs:

Annual billing discounts: Most established providers offer 20–30% discounts for annual prepayment. For a $25 monthly service, annual billing reduces costs to approximately $17.50–20 monthly—savings of $60–90 annually per service.

Stacking multiple annual subscriptions: Households using multiple specialized services (Kayo for sports, Stan for entertainment, Optus Sport for soccer) can compound savings. Three services at $20 monthly each ($60 combined) with annual billing at 25% discount drops to approximately $45 monthly—$180 annual savings.

Promotional timing: Providers offer discounted annual subscriptions during major events (pre-football season, holiday periods). Kayo frequently offers 50% off first-month promotions, while Fetch TV bundles hardware discounts with subscription commitments. Strategic timing can reduce first-year costs by 15–25%.

Bundling strategies: Some providers offer multi-service bundles (internet + IPTV, mobile + streaming) at combined discounts. Optus customers can bundle Optus Sport with mobile plans at reduced rates. Fetch TV hardware becomes cost-effective when bundled with extended subscriptions.

Gift subscriptions: Annual subscriptions make practical gifts. Family members gifting annual IPTV subscriptions can spread costs while providing recipients with year-long entertainment.

Risks and mitigation: Annual commitments carry risks if service quality deteriorates or viewing preferences change. Mitigate by:

- Using monthly billing for new services during 1–3 month evaluation periods

- Transitioning to annual billing only after confirming satisfaction

- Staggering annual renewal dates across different services to maintain some monthly flexibility

- Confirming refund policies before annual commitments

For Australians committed to specific services, annual billing represents the most effective strategy for reducing iptv monthly cost australia expenditure without sacrificing quality or features.

Minimizing Risk and Maximizing Value

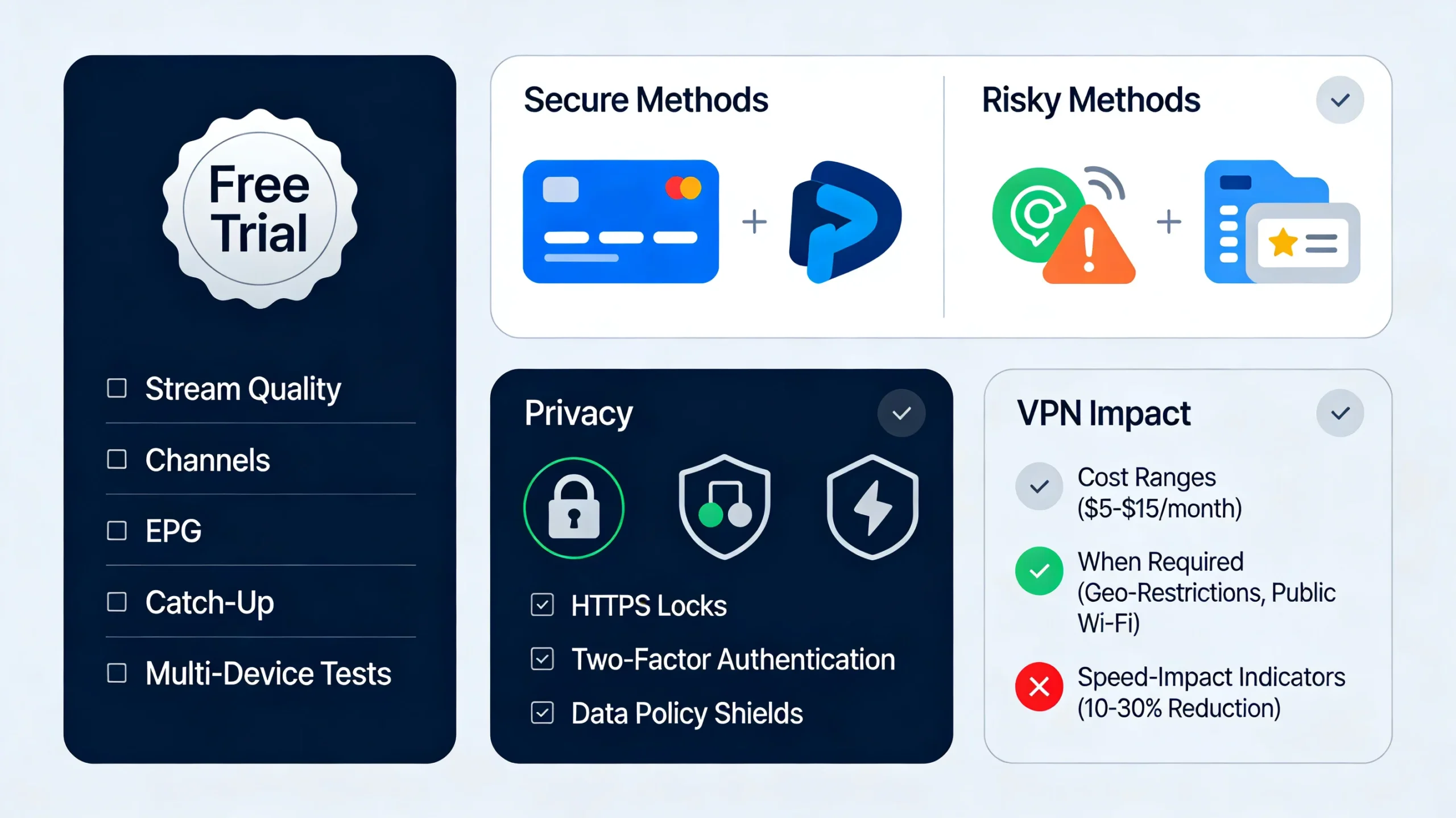

Importance of Trial Periods

Free trials eliminate financial risk while evaluating IPTV services:

Standard trial lengths: Most legal Australian IPTV providers offer 7–14 day free trials. Kayo Sports provides 7 days, while other services may extend to 14 days for first-time subscribers.

Trial evaluation checklist:

- Stream quality: Test during peak evening hours (7–10 PM) when network congestion is highest. Verify HD streaming remains stable on your NBN plan.

- Channel selection: Confirm advertised channels are actually available. Some providers list channels that appear in guides but don’t stream reliably.

- EPG functionality: Assess program guide usability, accuracy, and forward schedule depth.

- Catch-up TV: Test replay features across multiple channels to verify functionality and content retention periods.

- Multi-device performance: If paying for multi-stream capability, test simultaneous streaming across different devices to confirm smooth operation.

- App experience: Evaluate smart TV apps, mobile apps, and web interfaces for responsiveness and user-friendliness.

- Customer support: Test support channels with non-urgent questions to assess response times and helpfulness.

Trial best practices:

- Set calendar reminders 2–3 days before trial ends to avoid unwanted charges

- Test during planned high-usage periods (weekend sports, weeknight prime time)

- Document issues encountered for comparison between services

- Trial multiple services sequentially before committing to annual subscriptions

Free trials transform IPTV selection from gambles into informed decisions. Never commit to annual subscriptions without completing trial periods first.

Secure Payment Methods and Privacy Considerations

Payment security and privacy protection are essential when subscribing to IPTV services:

Preferred payment methods:

- Credit cards: Offer consumer protections, chargeback rights, and fraud monitoring. All legitimate Australian IPTV providers accept major credit cards (Visa, Mastercard, Amex).

- PayPal: Provides additional privacy layer by avoiding direct card number sharing with providers. PayPal’s dispute resolution mechanisms offer subscriber protection.

- Direct bank debit: Available through established providers but offers fewer consumer protections than credit cards.

Payment methods to avoid:

- Cryptocurrency: While offering anonymity, crypto payments provide zero consumer protection and are hallmarks of unregulated providers.

- Wire transfers: Irreversible payments with no fraud protection. Requests for wire transfers indicate high-risk services.

- Gift cards: Untraceable payment method commonly demanded by illegitimate providers. No legitimate Australian IPTV service requests gift card payments.

Privacy protection measures:

- Verify HTTPS encryption on provider websites before entering payment information

- Use unique, strong passwords for each IPTV service account

- Enable two-factor authentication when available

- Review privacy policies regarding data collection, storage, and sharing

- Avoid services requesting excessive personal information unrelated to service delivery

- Monitor bank statements for unauthorized charges following trial periods

Red flags indicating privacy risks:

- No published privacy policy or terms of service

- Requests for identity documents unrelated to age verification

- Demands for social media account access

- Excessive app permissions (location tracking, contact list access)

- Offshore company registration in privacy-unfriendly jurisdictions

Legitimate iptv plans australia providers operate transparently with clear privacy policies, secure payment processing, and appropriate data handling practices. Services failing these standards should be avoided regardless of pricing.

VPN Usage Impact on Total Monthly Cost

Virtual Private Networks add costs but provide benefits for specific IPTV use cases:

When VPNs are necessary:

- International service access: Services like Sling TV, fuboTV, or regional sports platforms geo-restrict content to specific countries. VPNs enable access to international IPTV libraries unavailable in Australia.

- Enhanced privacy: VPNs mask viewing habits from internet service providers and potential surveillance, appealing to privacy-conscious users.

- ISP throttling avoidance: Some internet providers throttle streaming traffic during peak periods. VPNs can circumvent throttling by encrypting traffic, preventing ISP traffic identification.

When VPNs are unnecessary:

- Domestic legal services: Australian IPTV providers like Kayo, Optus Sport, and Fetch TV don’t require VPNs. Using VPNs with domestic services can actually reduce performance by adding encryption overhead.

- Adequate privacy protections: Legal providers already encrypt streams and protect user data. VPNs add redundant privacy layers for domestic services.

VPN cost considerations:

- Monthly subscriptions: $10–15 AUD for quality providers (NordVPN, ExpressVPN, Surfshark)

- Annual subscriptions: $3–6 AUD monthly ($36–72 annually) with 40–60% discounts

- Free VPNs: Inadequate for streaming due to bandwidth limits, server congestion, and questionable privacy practices

VPN performance impacts:

- Speed reduction: Encryption overhead and routing through VPN servers reduces connection speeds by 10–30%, potentially impacting 4K streaming

- Server selection importance: Connecting to Australian VPN servers when accessing domestic content, or geographically close servers when accessing international content, minimizes speed impacts

- Split tunneling: Advanced VPN feature allowing selective traffic routing—stream IPTV through VPN while directing other traffic directly—optimizes performance

Total cost calculations including VPNs:

- Domestic legal IPTV only: VPN unnecessary, $0 additional monthly cost

- International IPTV access: $3–6 monthly (annual VPN subscription), adding 15–30% to base IPTV costs

- Privacy-focused streaming: $3–6 monthly premium for comprehensive privacy protection

For cheap legal iptv australia seeking, VPNs represent optional rather than essential costs unless accessing international services. Budget-conscious consumers should prioritize domestic providers, eliminating VPN expenses from monthly calculations.

Frequently Asked Questions

Is IPTV Legal in Australia and Does It Affect Monthly Cost?

IPTV technology itself is completely legal in Australia. The legal issue concerns content licensing, not the delivery method. Legal services like Kayo Sports, Optus Sport, and Fetch TV obtain proper broadcasting rights and compensate content creators appropriately.

Legal services cost between $12–60 monthly depending on content breadth and features. These providers offer reliable service, technical support, security, and full legal protection for subscribers.

Unregulated services offering unauthorized streams violate copyright laws. While individual subscriber prosecution remains rare, Australian law allows rights holders to pursue users of pirated streaming services. These services provide no reliability guarantees, customer support, or fraud protection.

The cost difference between legal and illegal services—typically $10–30 monthly—reflects the value of legal protection, reliability, and quality that justifies the modest premium for peace of mind.

Why Do Prices Vary So Much Between Providers?

IPTV pricing reflects several factors creating significant variation:

Content licensing costs: Sports rights, premium movies, and international content carry substantial licensing fees that directly impact subscription pricing.

Infrastructure investment: Reliable providers invest heavily in robust servers and content delivery networks to minimize buffering and downtime, elevating subscription prices but delivering superior experiences.

Market positioning: Some providers target budget-conscious consumers with competitive pricing, while others target premium audiences willing to pay more for comprehensive features and extensive libraries.

Bundling strategies: Telecom providers offering IPTV alongside internet services can offer competitive pricing through cross-subsidization, unlike standalone IPTV specialists.

Geographic restrictions: International services price for their home markets, creating pricing disconnects when converted to AUD.

Feature differentiation: Services offering 4K streaming, multiple simultaneous streams, and comprehensive DVR functionality charge premiums over basic providers.

Price variation doesn’t automatically indicate value differences. Evaluating iptv subscription price australia options requires comparing content alignment, features, and reliability against pricing.

Are There One-Off Setup Costs to Consider?

Initial setup costs vary significantly among providers:

Services with no setup costs:

- Kayo Sports and Optus Sport work on existing devices (smart TVs, smartphones, tablets) with zero setup fees

- International services require no setup fees, though may need VPN subscriptions

Services requiring hardware:

- Fetch TV requires proprietary set-top boxes (Mighty $449, Mini $199) or bundled with internet plans

- Specialized IPTV boxes cost $60–200 one-time

Optional costs:

- Premium streaming devices: Apple TV 4K ($219–319), Fire TV Stick 4K ($79–99)

- Network improvements: Ethernet cables ($10–30), mesh Wi-Fi systems ($200–600)

- Professional installation: $50–150

When calculating first-year iptv monthly cost australia, factor in hardware costs. A $25 monthly service with $450 hardware effectively costs $62.50 monthly in year one, dropping to $25 monthly in subsequent years.

Does Australian Internet Speed Affect IPTV Costs?

Internet speed dramatically impacts IPTV functionality:

Minimum speed requirements:

- SD streaming: 3–4 Mbps per stream (NBN 12 adequate)

- HD streaming: 5–8 Mbps per stream (requires NBN 25+)

- 4K streaming: 25+ Mbps per stream (requires NBN 50+)

NBN plan costs:

- NBN 12: $50–65 monthly—inadequate for quality IPTV

- NBN 25: $60–75 monthly—suitable for single HD stream

- NBN 50: $70–85 monthly—supports 2–3 HD streams comfortably

- NBN 100: $80–100 monthly—enables multiple HD streams and 4K content

IPTV doesn’t directly increase internet costs, but optimal viewing may require plan upgrades. Households on NBN 25 experiencing buffering may need to upgrade to NBN 50 ($10–15 additional monthly).

Optimization strategies:

Consider mesh Wi-Fi systems instead of upgrading internet plans

Schedule large downloads during off-peak hours

Use ethernet connections for IPTV devices

Limit background applications consuming bandwidth

Can Yearly Subscriptions Reduce Monthly Costs?

Annual subscriptions represent the most effective strategy for reducing iptv monthly cost australia expenditure:

Typical discount structures:

- Monthly billing baseline: Standard advertised rates without discounts

- Quarterly billing: 10–15% savings (effectively 1.5 months free annually)

- Annual billing: 20–30% savings (effectively 2.5–4 months free annually)

Real-world examples:

- Service at $25 monthly standard rate

- Annual billing at 25% discount: $225 yearly ($18.75 effective monthly)

- Annual savings: $75 (three months free)

Multi-service compounding: Households using multiple services multiply savings:

- Three services at $20 each monthly: $60 combined, $720 annually

- Same services with annual billing at 25% discount: $540 annually

- Total annual savings: $180 (equivalent to 3 months of all services free)

Additional benefits beyond direct discounts:

- Locked-in pricing protection against mid-year price increases

- Simplified billing with single annual transaction rather than 12 monthly charges

- Reduced payment processing fees (some providers pass savings to annual subscribers)

- Promotional bonuses (some providers offer additional free months or premium features for annual commitments)

Strategic implementation:

- Start all new services with monthly billing during 1–3 month evaluation periods

- After confirming service satisfaction and regular usage, switch to annual billing before next renewal

- Set calendar reminders for annual renewal dates to evaluate continued value

- Stagger annual renewals across different services (e.g., Kayo in January, Stan in April, Optus Sport in July) to maintain monthly flexibility

Risk mitigation:

- Verify refund policies before annual commitments (some providers offer partial refunds for cancelled annual subscriptions)

- Use credit cards rather than debit cards for annual charges to access chargeback protections

- Avoid annual commitments with new, unestablished providers lacking track records

- Maintain at least one service on monthly billing for maximum flexibility

For Australians seeking best iptv deals australia, annual billing delivers the most substantial savings—often $50–100 per service annually—without sacrificing quality, features, or content. After confirming service value through initial monthly billing periods, transitioning to annual subscriptions optimizes long-term costs.

Conclusion: Making Smart IPTV Cost Decisions in Australia

Understanding iptv monthly cost australia requires looking beyond advertised subscription prices to consider total expenditure including hardware, internet requirements, VPN subscriptions, and setup fees. Legal IPTV services in Australia range from specialized budget options like Kayo Sports at $12 monthly to comprehensive premium packages exceeding $60 monthly, with mid-tier services around $20–35 providing optimal value for most households.

The Australian IPTV landscape offers legitimate alternatives to traditional pay TV at substantially reduced costs. Strategic service selection aligned with actual viewing preferences, combined with annual billing discounts and infrastructure optimization, can reduce household television costs by 40–70% compared to traditional pay TV while maintaining or improving content access.

Legal providers deliver reliability, customer support, and peace of mind that justify price premiums over unregulated services. The $10–30 difference between legal and illegal services reflects investments in infrastructure, licensing, and support that protect subscribers from legal risks, fraud, and service failures.

For Australian households, optimal IPTV cost management involves:

- Identifying core content priorities (sports, entertainment, international programming)

- Selecting specialized services aligned with priorities rather than bloated packages

- Using free trials to evaluate services before commitments

- Upgrading to annual billing after confirming satisfaction to maximize savings

- Optimizing NBN plans to support IPTV streaming without over-purchasing bandwidth

- Avoiding unnecessary VPN costs when using domestic legal services

The future of television in Australia is unmistakably internet-based. Understanding iptv plans australia 2026 pricing structures, hidden costs, and value optimization strategies empowers consumers to navigate this landscape effectively, accessing desired content at minimized costs while supporting legitimate providers creating sustainable streaming ecosystems.

Ready to find the best iptv monthly cost australia for your household? Visit IPTVAUSSIE.com for expert-tested guides, comprehensive provider reviews, NBN optimization tips, and exclusive free trial recommendations. Our team tests services across real Australian NBN connections to deliver accurate, experience-based advice you can trust. Start saving on your TV bill today while enjoying better content, greater flexibility, and complete peace of mind with legal streaming solutions tailored for Australian viewers.