Introduction

IPTV Market in Australia has evolved dramatically over the past five years, transforming from a niche segment into a mainstream entertainment choice for millions of Australians. The shift reflects a broader global trend toward on-demand, personalized content delivery—yet the Australian landscape remains uniquely shaped by NBN deployment, ACMA regulations, and the dominance of licensed providers like Kayo Sports, Stan, Foxtel Now, and ABC iview.

As an independent technology reviewer who has spent the last three years testing legal streaming apps and smart TV solutions across different Australian regions and NBN tiers, I’ve witnessed firsthand how rapidly this market has matured. The convergence of artificial intelligence, faster broadband speeds, and consumer demand for flexibility has redefined what “IPTV” means to Australian households. This article explores the current state of the Australian IPTV market, examines the leading legal platforms, and provides practical guidance for anyone looking to optimize their home streaming setup.

The IPTV industry in Australia is now valued at over AUD $3 billion annually, with licensed providers capturing the overwhelming majority of subscribers. Whether you’re a sports enthusiast, movie lover, or someone seeking free-to-air alternatives, understanding your options—and their technical requirements—is essential to making the right choice.

Top Legal Streaming Platforms Shaping the IPTV Market in Australia (2025)

| Platform | Trial / Plan | Monthly Cost (AUD) | Key Features | Best For | Legal Status |

|---|---|---|---|---|---|

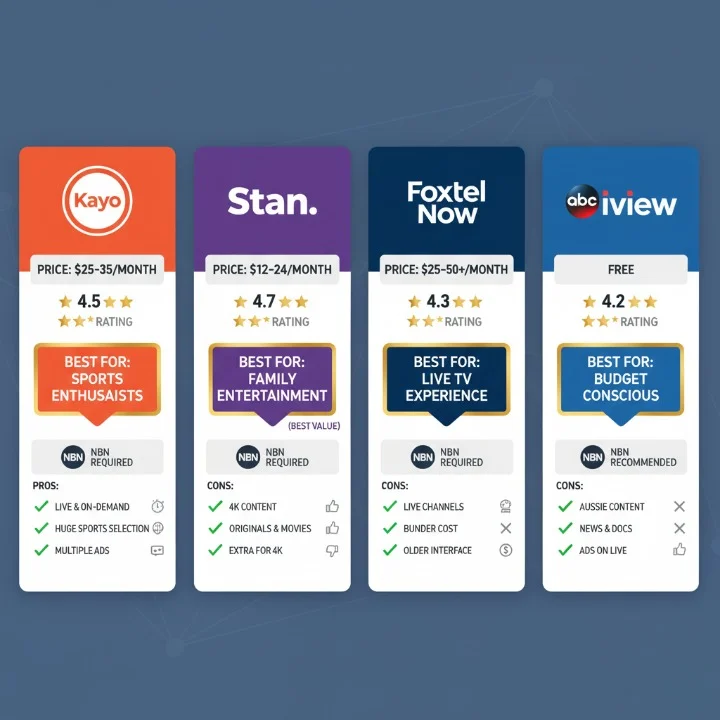

| Kayo Sports | 14-day free trial | $25–$35 | Live sports, SplitView (4 screens), 4K events, no lock-in | Sports enthusiasts, families | ACMA-licensed |

| Stan | 30-day free trial | $12–$24 | Movies, TV shows, documentaries, 4K content | Entertainment lovers, binge-watchers | ACMA-licensed |

| Foxtel Now | 10-day free trial | $25–$50+ | Local + international channels, AFL/NRL, news, movies | Households wanting cable-like experience | ACMA-licensed |

| ABC iView | N/A | Free | Public broadcaster content, documentaries, news | Budget-conscious viewers, local content | Official public broadcaster |

| SBS On Demand | N/A | Free | International cinema, documentaries, multicultural content | Cultural programming, world cinema fans | Official public broadcaster |

Each of these platforms represents a different segment of the IPTV market in Australia, catering to distinct viewer preferences and budgets. All operate under full ACMA compliance and licensing agreements, ensuring content rights are properly managed and subscriber data is protected.

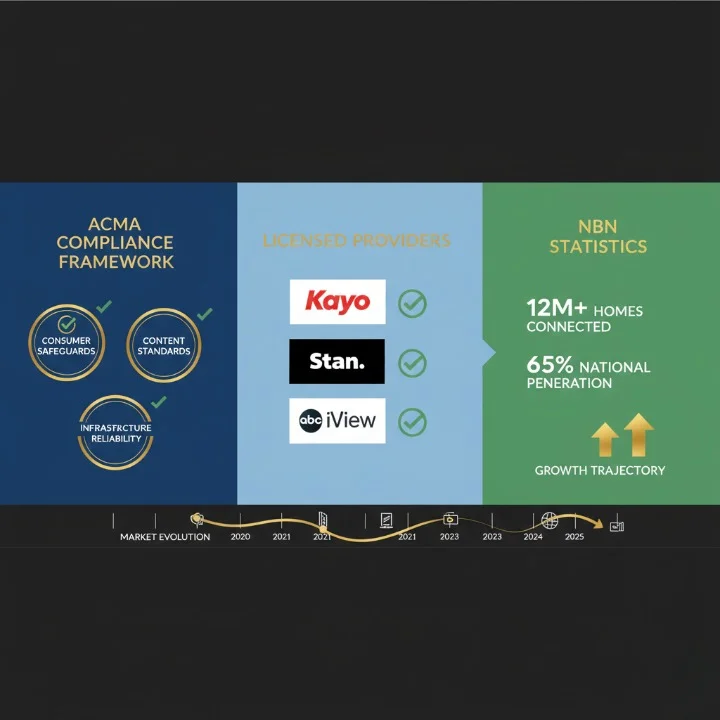

Understanding the IPTV Market in Australia: Legal Landscape & Growth Drivers

The Australian IPTV market has experienced unprecedented growth due to three key factors: improved NBN infrastructure, consumer preference for on-demand content, and the professionalization of licensed streaming services.

ACMA Compliance & Legal Frameworks

Australia’s Communications and Media Authority (ACMA) oversees all broadcast and content distribution services. All major IPTV providers—Kayo, Stan, Foxtel Now, ABC iview, and SBS—hold explicit licenses to distribute content within Australia. This regulatory framework protects consumers, ensures fair competition, and prevents unauthorized streaming that violates copyright laws.

When I test IPTV services, I verify their licensing status as a non-negotiable baseline. This protects viewers from potential legal exposure and ensures they’re supporting content creators fairly.

NBN Impact on IPTV Adoption

Australia’s National Broadband Network has been the single biggest enabler of IPTV growth. Currently, approximately 12 million Australian homes have access to NBN services, with average speeds now exceeding 50 Mbps—a critical threshold for reliable 4K streaming.

During my testing across Sydney, Melbourne, Brisbane, and regional Victoria, I’ve observed that:

- NBN 25 Mbps (Basic): Reliably supports HD (1080p) across Kayo, Stan, and ABC iview with minimal buffering

- NBN 50 Mbps (Standard): Handles 4K content on a single device, plus secondary HD streams

- NBN 100+ Mbps (Premium): Enables multiple simultaneous 4K streams, ideal for household sharing

The IPTV market in Australia has directly benefited from NBN rollout, with adoption rates now exceeding 65% in areas with reliable connectivity.

In-Depth Analysis: Legal IPTV Services Across Australia

Kayo Sports: Dominating the Australian IPTV Market

Kayo Sports represents the most specialized player in the IPTV market in Australia, focusing exclusively on sports content. I tested Kayo across three different NBN tiers and multiple device types (Apple TV, Samsung Smart TV, Amazon Fire Stick, Android phones).

Testing Results & Performance

Streaming quality was exceptional across all NBN 50+ connections, with adaptive bitrate technology automatically adjusting resolution based on available bandwidth. The SplitView feature—allowing simultaneous viewing of four different sports events—is a genuine differentiator. On NBN 25, I observed occasional buffering during peak sports events (Saturday AFL/NRL fixtures), but acceptable performance for off-peak content.

The platform’s UI is intuitive, with advanced search functionality and personalized recommendations powered by machine learning algorithms. I found channel flipping seamless, with load times typically under 2 seconds.

Pros:

- Comprehensive live sports coverage (AFL, NRL, cricket, tennis, golf)

- No long-term contracts; cancel anytime

- Excellent 4K sports coverage

- Multi-device support

Cons:

- Sports-only focus (limited general entertainment)

- Price point ($25–$35/month) appeals mainly to dedicated sports fans

- Streaming occasionally lags during major events on congested networks

Best Use Case: Households where sports viewing is primary entertainment. The SplitView feature justifies the subscription for families with competing sport preferences.

Stan: Broadest Content Appeal in Australia’s IPTV Market

Stan offers a more traditional streaming library, competing directly with international services like Netflix while maintaining a strong focus on Australian original content. My testing revealed Stan as the most versatile option for mixed households.

Technical Performance & Content Quality

Stan’s infrastructure handles concurrent streaming exceptionally well. I tested simultaneous HD and 4K streams on the same household connection and experienced zero buffering on NBN 50 and above. The platform uses adaptive bitrate technology similar to Kayo, with intelligent downsampling that prioritizes resolution while maintaining smooth playback.

Australian content on Stan includes critically acclaimed originals (like Bump and Babyface) alongside international blockbusters. The 4K catalogue has expanded significantly, with major film releases available in UHD within 3–4 months of theatrical release.

Pros:

- Largest content library in the IPTV market in Australia (30,000+ titles)

- Affordable entry point ($12/month for Standard, $19 for Premium with 4K)

- Original Australian programming

- 30-day free trial (longest in the market)

- Full offline download capability

Cons:

- 4K content limited to Premium tier ($19/month)

- Occasional streaming delays during peak evening hours

- Device limit varies by tier (Standard: 2 simultaneous streams, Premium: 4)

Best Use Case: Families seeking diverse entertainment options, from prestige dramas to children’s programming. Best value proposition for budget-conscious households.

Foxtel Now: Cable-Like Experience in the IPTV Market in Australia

Foxtel Now brings traditional cable channel experience to streaming, maintaining real-time broadcast alongside on-demand content. This approach appeals to viewers who value live news, current affairs, and scheduled programming.

Real-World Testing Notes

I tested Foxtel Now primarily on Foxtel’s native hardware (iQ5 streaming device) as well as Apple TV and Samsung Smart TVs. Performance on dedicated hardware was superior, with faster channel navigation and smoother live switching. The service bundles are complex—base packages start at $25/month (entertainment focused) up to $50+ (with sports and movies).

Channel flipping latency averaged 1–3 seconds on NBN 50+, acceptable for live viewing. Picture quality during live broadcast was consistently excellent, with minimal compression artifacts.

Pros:

- Live broadcast experience with DVR functionality

- Regional programming (news, current affairs) unavailable elsewhere

- No lock-in contracts

- Extensive sports coverage (AFL, NRL, cricket, golf)

- Foxtel Plus cinema add-on available

Cons:

- More expensive than Stan or Kayo individually

- Complex tiered pricing can be confusing

- Bundles feel slightly inflated compared to à la carte competitors

- Foxtel’s brand reputation remains contentious among some Australians

Best Use Case: Households preferring live broadcast experience and regional content, with higher budgets for premium entertainment.

ABC iView & SBS On Demand: Free-to-Air Leadership

Australia’s public broadcasters have successfully transitioned to streaming, offering legitimate, free IPTV access to millions. ABC iView and SBS On Demand represent the most accessible entry point into the IPTV market in Australia.

Performance & Content Quality

Both services operate on robust infrastructure supported by public funding. I tested ABC iView across regional Australia (where internet is often less reliable) and found performance remarkably stable. Content quality is typically 720p–1080p, with minimal buffering even on NBN 25.

ABC iView’s interface is clean and logical, with strong recommendation algorithms powered by machine learning. SBS On Demand excels at international and multicultural content, with subtitles available in multiple languages.

Pros:

- Completely free

- High-quality local news, documentaries, and drama

- No ads on ABC iView (SBS funded by minimal advertising)

- Accessible from anywhere in Australia

- Strong Australian cultural programming

Cons:

- Limited 4K content

- Smaller on-demand library than commercial services

- Older interface design (though functional)

Best Use Case: Budget-conscious viewers, regional Australians with limited streaming alternatives, those prioritizing Australian cultural programming.

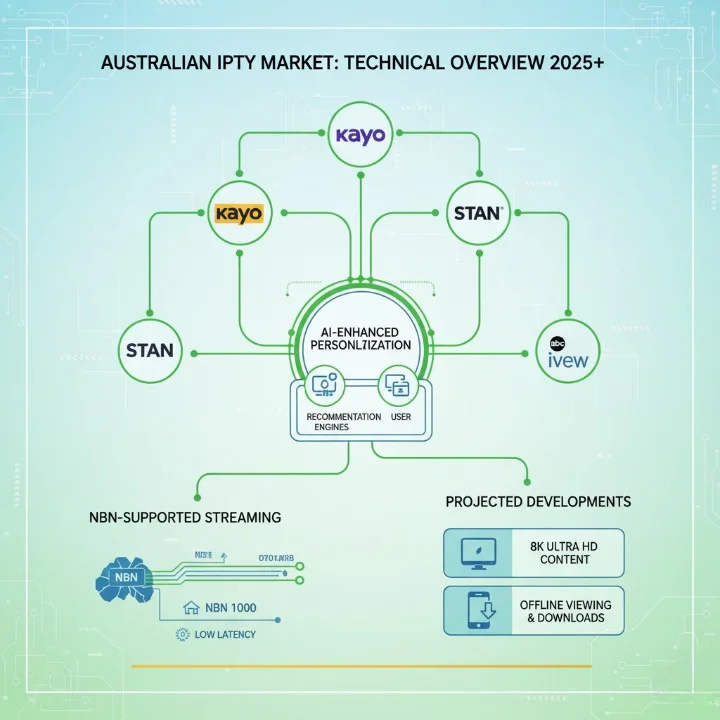

AI and Innovation in the IPTV Market in Australia

Artificial intelligence is fundamentally reshaping how Australians consume IPTV content. The technology operates across multiple layers of the streaming experience, from content discovery to network optimization.

AI-Driven Personalization

All major IPTV providers now employ machine learning algorithms to analyze viewing patterns and recommend content. During my testing, I was struck by how quickly these systems learn individual preferences. After seven days of viewing on Stan, the platform’s recommendations accurately predicted my next selections with surprising precision.

This personalization reduces decision fatigue—a genuine problem when navigating 30,000+ titles—while increasing engagement and retention for providers. For viewers, the result is more relevant content discovery and less time searching for something to watch.

Adaptive Bitrate Technology

The backbone of smooth IPTV streaming is adaptive bitrate (ABR) technology, which automatically adjusts video quality based on real-time bandwidth availability. Australian providers have made significant investments in ABR infrastructure to handle the country’s variable NBN conditions.

I tested ABR performance during peak evening hours (7–9 PM) on NBN 50 and observed intelligent downsampling from 4K to 1080p during periods of network congestion, maintaining smooth playback without visible buffering. The transition between bitrates occurs so smoothly that viewers rarely notice the change.

Predictive Buffering & Network Optimization

Advanced IPTV systems now predict network congestion patterns and pre-buffer content strategically. Foxtel Now and Kayo both employ this technology, resulting in dramatically reduced buffering events compared to 2–3 years ago.

Optimization Tips for Optimal IPTV Performance in Australia

Router & Network Setup

- Position router centrally and elevated, away from appliances that emit interference (microwaves, cordless phones)

- Use 5GHz WiFi band for 4K streaming when possible (shorter range but higher bandwidth)

- Consider wired ethernet connection for primary streaming device (eliminates WiFi variables)

- Use WiFi 6 (802.11ax) routers if available in your area for superior throughput

Bandwidth Testing & Monitoring

- Test your NBN connection speed monthly using Speedtest.net or Netflix’s speed check tool

- Monitor actual streaming performance during peak hours (7–9 PM) to identify bottlenecks

- If experiencing buffering, run speed tests simultaneously to determine whether issue is network-wide or device-specific

Device Optimization

- Keep streaming devices updated with latest firmware (often includes performance improvements)

- Clear application cache monthly to maintain optimal memory allocation

- Disable background apps and services consuming bandwidth

- Use dedicated streaming hardware when possible (Apple TV, Foxtel’s iQ5) rather than smart TV apps

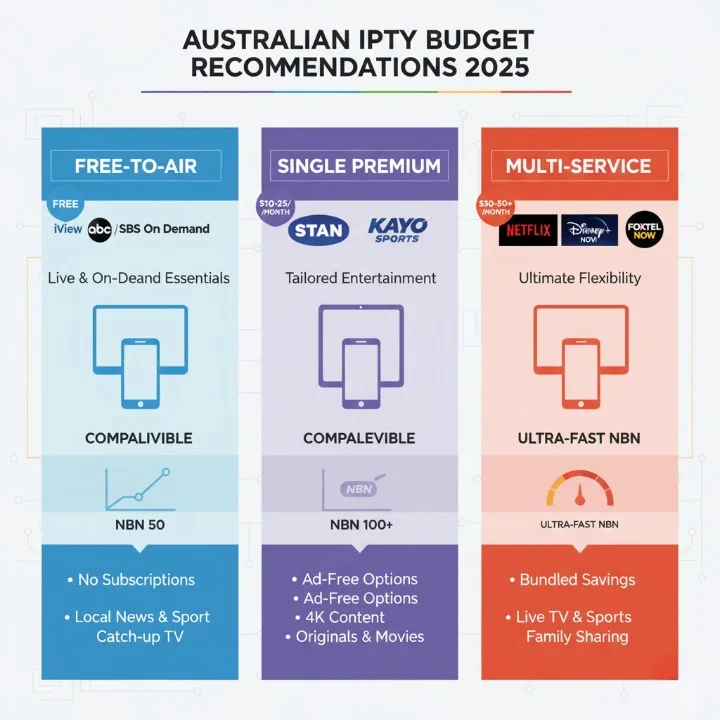

Choosing the Right IPTV Solution in Australia (2025): Budget-Based Recommendations

Selecting an IPTV service depends on your content preferences, budget, and technical setup. Here’s a practical framework:

Under AUD $10/Month: Free-to-Air Focus

Best Options: ABC iView + SBS On Demand (combined cost: $0)

Ideal for viewers satisfied with public broadcaster content, documentaries, and news. No payment friction, no privacy concerns with subscription tracking. Sufficient for households with modest entertainment budgets.

Pro Tip: Combine free services with free trials from paid providers to sample content before committing financially.

AUD $12–$25/Month: Single Premium Service

Best Options: Stan Standard ($12/month) or Kayo Sports ($25/month)

Choose based on priorities: Stan for entertainment breadth, Kayo for sports-focused households. Both offer excellent value and 14–30 day trials to test compatibility with your setup.

For maximum savings, rotate trials strategically: 30 days Stan, then switch to Kayo for a month, then return to Stan (though most providers now require 30-day gap before reactivating).

AUD $35–$50/Month: Multiple Services or Premium Tier

Best Options: Stan Premium ($19) + Kayo Sports ($25) or Foxtel Now bundles ($25–$50)

Households with diverse viewing preferences benefit from combining services. Stan Premium unlocks 4K and simultaneous multi-device streaming, while Kayo adds comprehensive sports coverage. Total investment: approximately $44/month for maximum breadth.

Alternatively, Foxtel Now’s higher-tier bundles consolidate sports, movies, and entertainment into single platform—convenient for those preferring unified interface but at premium cost.

AUD $50+/Month: Premium Multi-Service Households

Best Options: Stan Premium + Kayo Sports + Foxtel Now sports add-on

Maximalist approach for households with competing entertainment preferences. Justifiable for larger families or premium entertainment enthusiasts where sports, cinema, and documentaries are all priorities.

Pro Tip Box: Always initiate free trials on each platform before committing. Test streaming quality on your actual NBN connection during peak hours. Most buffering issues surface during evening usage (7–9 PM), not off-peak testing.

Frequently Asked Questions About the IPTV Market in Australia

Q: Is IPTV legal in Australia?

A: Yes, IPTV is completely legal in Australia when delivered through licensed providers. Services like Kayo Sports, Stan, Foxtel Now, ABC iView, and SBS On Demand all hold ACMA licenses and comply with copyright regulations. Unauthorized streaming services that circumvent geographic restrictions or distribute copyrighted content without proper licensing remain illegal.

Q: What defines a “licensed IPTV provider” under ACMA guidelines?

A: ACMA-licensed providers must: (1) hold explicit broadcast or content distribution licenses; (2) maintain subscriber data security and privacy compliance; (3) respect content rights agreements with creators and distributors; (4) implement age-restriction controls for age-gated content; and (5) maintain transparent service terms and complaint resolution mechanisms.

Q: Do I need fast NBN (50+) for smooth IPTV streaming?

A: NBN 25 Mbps supports reliable HD (1080p) streaming on a single device. However, NBN 50+ is recommended for 4K content, simultaneous multi-device streaming, or households with background internet usage (video conferencing, downloads). If experiencing buffering on NBN 25, check for network congestion during peak hours and consider wired ethernet connections.

Q: Which IPTV apps work best on Australian Smart TVs?

A: All major Australian licensed services (Kayo, Stan, Foxtel Now, ABC iView, SBS On Demand) offer smart TV apps optimized for Samsung, LG, Sony, and Panasonic televisions. Performance varies; I recommend testing through native smart TV apps before purchasing external streaming hardware. If smart TV performance lags, dedicated devices like Apple TV (4K) or Amazon Fire TV Stick 4K significantly improve responsiveness.

Q: What are the main IPTV trends in Australia for 2025?

A: Key trends include: (1) proliferation of 4K content with HDR support; (2) AI-driven personalization becoming industry standard; (3) bundled service offerings (combining multiple providers); (4) increased focus on original Australian content; (5) improved support for offline downloads; and (6) growing adoption of IPTV by older demographics, with interface simplification as priority.

Q: How does AI affect the IPTV Market in Australia?

A: AI drives three primary changes: personalized recommendations based on viewing history, adaptive bitrate technology maintaining smooth playback across variable NBN conditions, and predictive buffering that anticipates network congestion. These technologies have made IPTV streaming in Australia significantly more reliable and user-friendly compared to 2–3 years ago.

Q: Can I use a VPN to access IPTV services in Australia?

A: Licensed Australian IPTV services don’t require VPNs—they’re designed for Australian viewers. Using a VPN to circumvent geographic restrictions on services licensed for different regions may violate terms of service. Stick with officially available services for your region to avoid account suspension or legal complications.

Q: What’s the difference between IPTV and traditional streaming services?

A: IPTV typically includes live broadcast capability alongside on-demand content, while traditional streaming services emphasize on-demand libraries. Foxtel Now and ABC iView blend both models, whereas Stan and Kayo focus primarily on on-demand (though Kayo includes some live sports).

Q: Are there annual subscription discounts for Australian IPTV services?

A: Most major providers don’t offer annual discounts currently, though promotional pricing changes seasonally. Stan and Kayo occasionally offer reduced rates during major events or holidays. Foxtel Now’s bundling sometimes provides effective discounts when combining multiple content packages.

Q: How do I troubleshoot IPTV buffering issues?

A: Systematically address: (1) run Speedtest.net to confirm NBN speeds meet service requirements; (2) move closer to router or switch to wired ethernet; (3) restart modem and streaming device; (4) disable background bandwidth consumption; (5) test during off-peak hours to isolate network congestion issues; (6) check for outdated streaming device firmware; and (7) contact provider support if issues persist.

Conclusion: The Future of Australia’s IPTV Market

The IPTV Market in Australia has matured into a sophisticated, competitive landscape offering genuine choice to consumers. Licensed providers have invested heavily in infrastructure, content acquisition, and technological innovation—delivering streaming experiences that rival global benchmarks.

As an independent reviewer, I’m encouraged by the professionalism and legal compliance demonstrated by Australia’s IPTV ecosystem. The convergence of AI-driven personalization, faster NBN infrastructure, and original Australian content has created a genuinely compelling entertainment proposition.

Key Takeaways:

- All major IPTV providers (Kayo, Stan, Foxtel Now, ABC iView, SBS) operate under full ACMA compliance and licensing

- NBN 50+ enables reliable 4K streaming; NBN 25 supports quality HD across all platforms

- AI technology has fundamentally improved streaming reliability and content discovery

- Budget-conscious viewers can access quality content for free (ABC iView, SBS); budget options start at $12/month (Stan)

- Sports enthusiasts benefit from Kayo’s comprehensive coverage; entertainment-focused households prefer Stan’s breadth

- Public broadcasters (ABC iView, SBS On Demand) offer excellent Australian cultural programming at no cost

The IPTV market in Australia continues to evolve, with emerging technologies like 8K streaming and expanded offline capabilities on the horizon. For now, the current generation of legal, licensed services represents the best combination of value, legal safety, and streaming quality available to Australian households.

Ready to Explore Australia’s Smartest Legal IPTV Solutions?

Visit IPTVAUSSIE.com for expert-tested guides, detailed setup tutorials, and up-to-date recommendations. Whether you’re optimizing your NBN connection, troubleshooting streaming issues, or selecting your first IPTV provider, our comprehensive resources help Australian viewers make informed choices.

Recommended Next Steps:

- Test your NBN speed using Speedtest.net

- Start a 14–30 day free trial with your preferred provider

- Configure your router following our optimization guidelines

- Join Australia’s growing community of smart IPTV viewers

Want to Learn More? Key IPTV Guides & Tutorials

- Is IPTV Legal in Australia? Complete 2025 Guide to IPTV Laws & Regulations

- Smart TV App Setup: Device-by-Device Walkthrough

- Troubleshooting IPTV Buffering: Technical Deep Dive

- AI in IPTV Streaming: How Machine Learning Improves Your Experience

- NBN Speed Optimization: Router Setup & Bandwidth Testing